Online Financial forecast software GAAP and IFRS

Analysis, forecasting and automatic reporting

Financial Forecasting. Made it Easy

- • Very easy to use, you just have to enter the assumptions or the expected KPIs

- • The tool performs a dual analysis of the business: 1. Actual analysis of the company based on the financial statements entered 2. Forecasting based on the assumptions. All financial statements and KPIs (Balance Sheet, Income Statement, Cash-flow Statement) are automatically generated

- • You can choose between two forecasting mode: a ‘business as usual’ automatic projection and a custom mode where you can customize the assumptions

- • Calculate commented financial ratios categorized into four management areas with industry-specific benchmark data

Automatic Reporting

Automatic reporting

Automatic dynamic comments

Downloadable and editable

Download formats

Designed either for Finance Pros and Beginners

- Economic and financial analysis of both listed and unlisted companies;

- Effective financial communication to stakeholders, through a professional and fine report;

- Creditworthiness assessment and company rating;

- Investment and financing decisions by managers or external stakeholders.

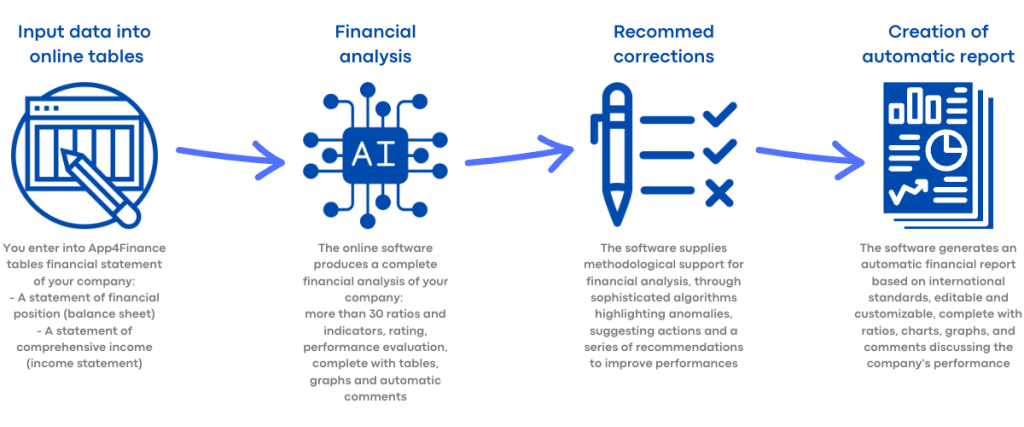

How it works

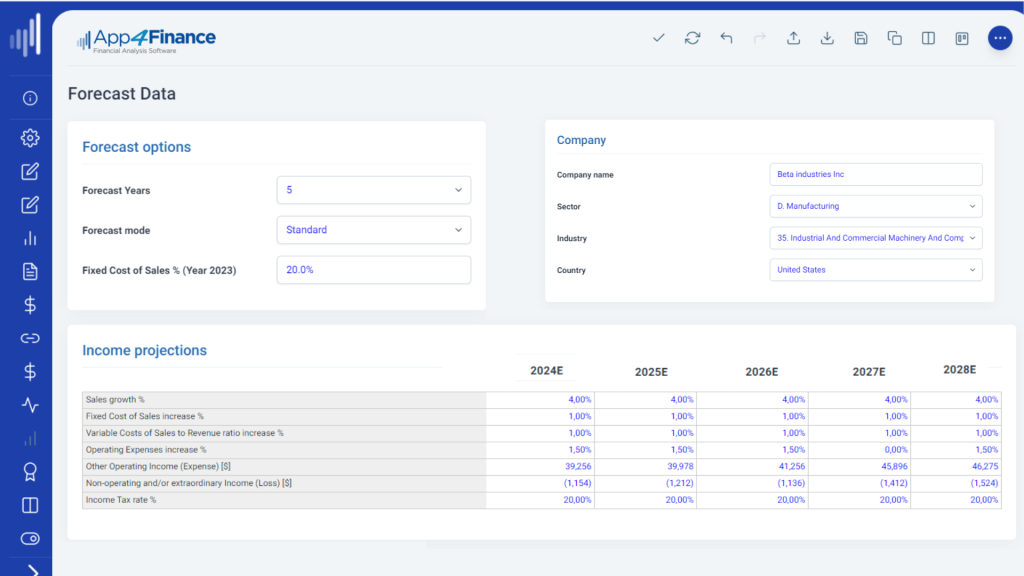

You can choose between two forecasting modes:

- ‘Business as Usual’: the system automatically projects financial data based on the historical figures. You will only need to enter the revenue growth rate, while the main KPIs will be kept constant, and the business will be projected in the absence of extraordinary events

- Alternatively, you can freely input the forecast assumptions, so to edit the cost projection parameters, as well as the DSO (Days Sales Outstanding), DPO (Days Payable Outstanding), and DIO (Days Inventory Outstanding) parameters. You can also plan for investments and financing, both in equity and debt capital.

INPUT DATA

Actual financial data

All you need is to enter financial data of the company you intend to assess, classified according to IFRS or US GAAP: Balance Sheet and Income Statement

Forecast data

You just have to enter the assumptions or the expected KPIs between two forecasting modes:

– ‘Business as Usual’

– Advanced forecast assumptions

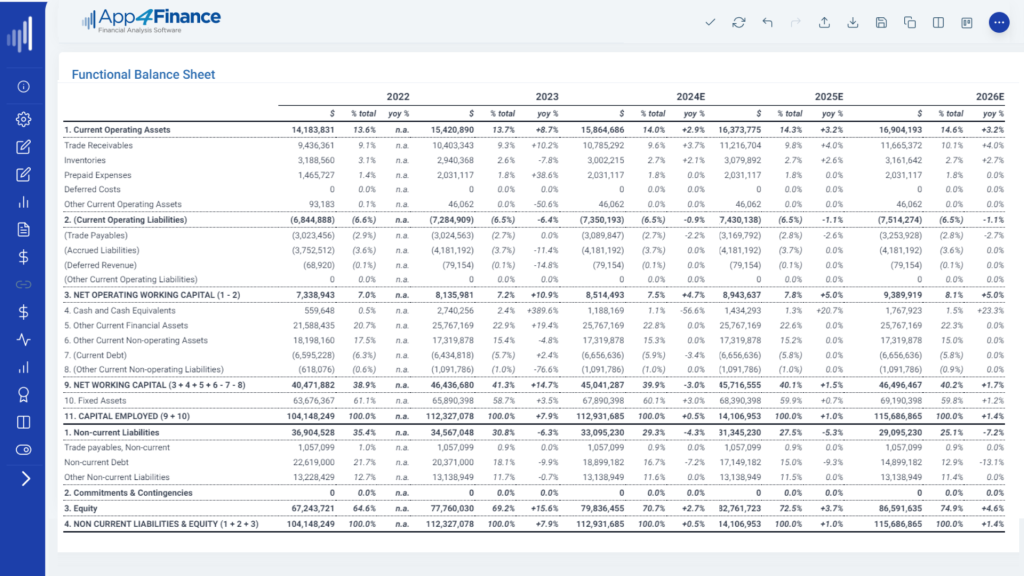

RECLASSIFIED FINANCIALS

Reclassification of Balance Sheet:

Financial balance sheet

Functional Balance Sheet

This format presents useful information for investors as it allows identification of the sources of financing (equity and third-party funds) and the investment of financial resources in fixed and working capital.

Reclassification of Income Statement:

Cost of sales

Value Added

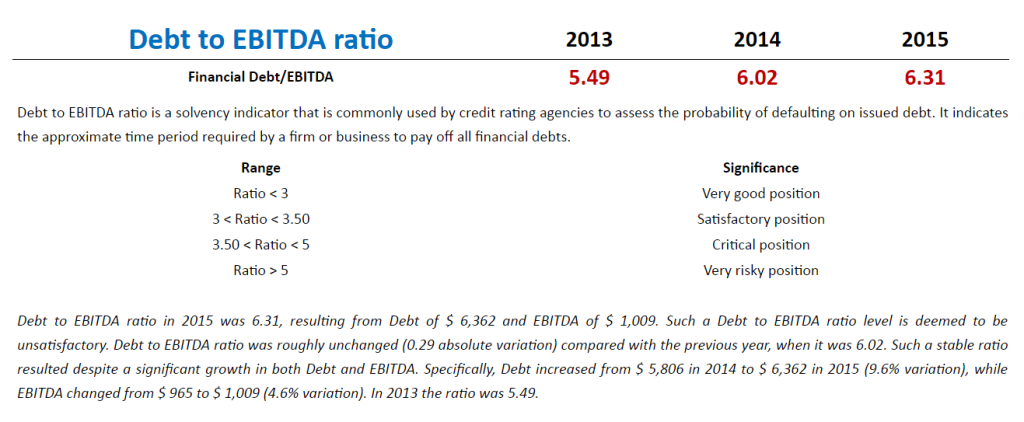

Reclassified Income Statement separates operating costs from non-operating ones, highlighting EBIT and EBITDA margins. This allows to evaluate essential ratios, such as EBIT to Interest Expense and Debt to EBITDA. Costs are classified into cost of sales and other specific categories, according to their destination.

FINANCIAL HIGHLIGHTS

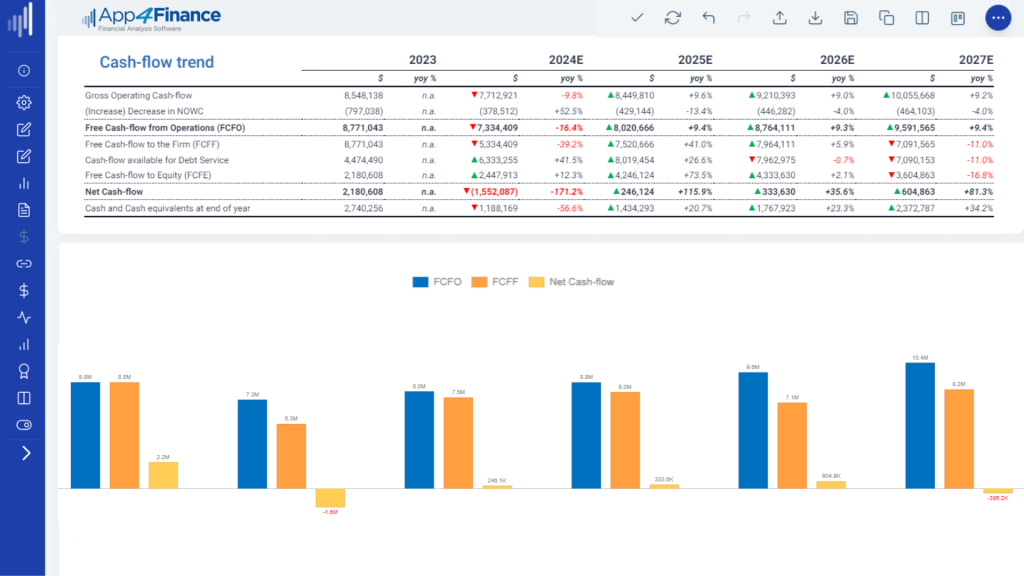

Cash-flow Statement

In this way, you can have a highlights of the generation and absorption of financial resources occurred during the year, divided into the main management areas.

The software automatically calculates the Free cash Flow to the Firm and to Equity

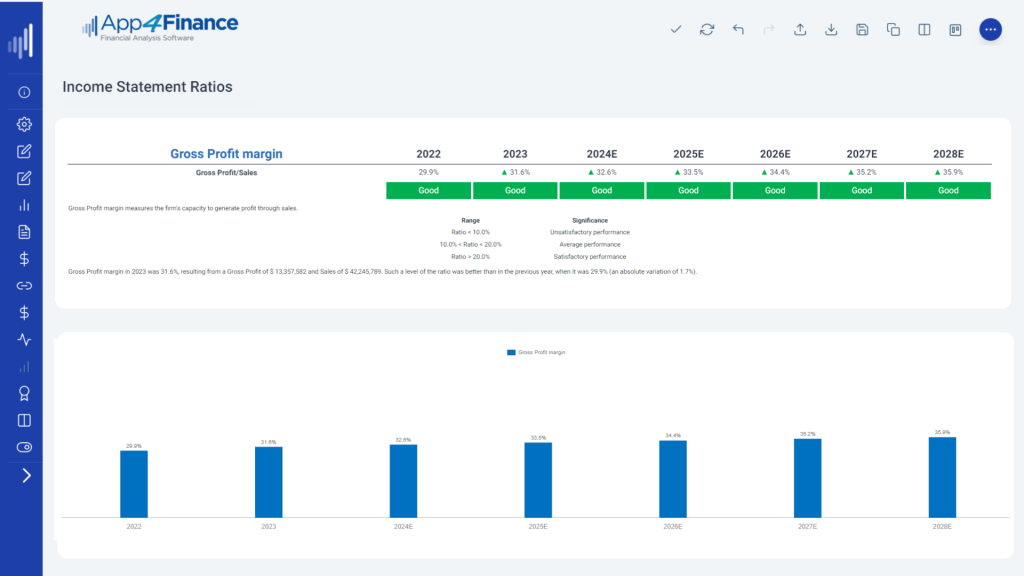

RATIOS

Profitability ratios

Liquidity analysis

Capital structure ratios

Solvency ratios

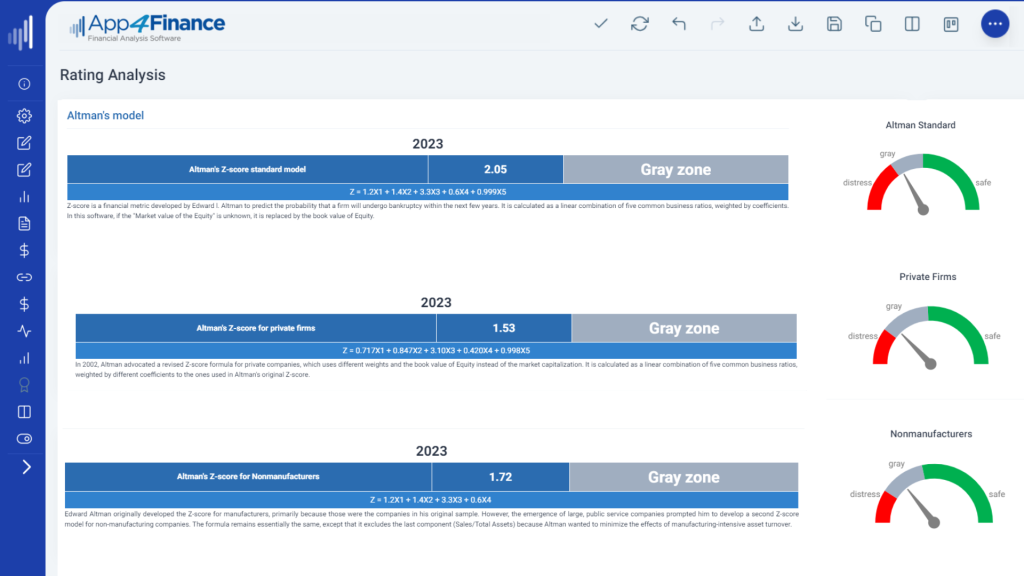

RATING ANALYSIS

Taffler’s model It is an alternative model to assess the likelihood of bankruptcy, based on different parameters and weights, obtained through a specific research on UK companies.

Springate’s model It assigns a score associated to a certain risk of bankruptcy. It is USA specific.

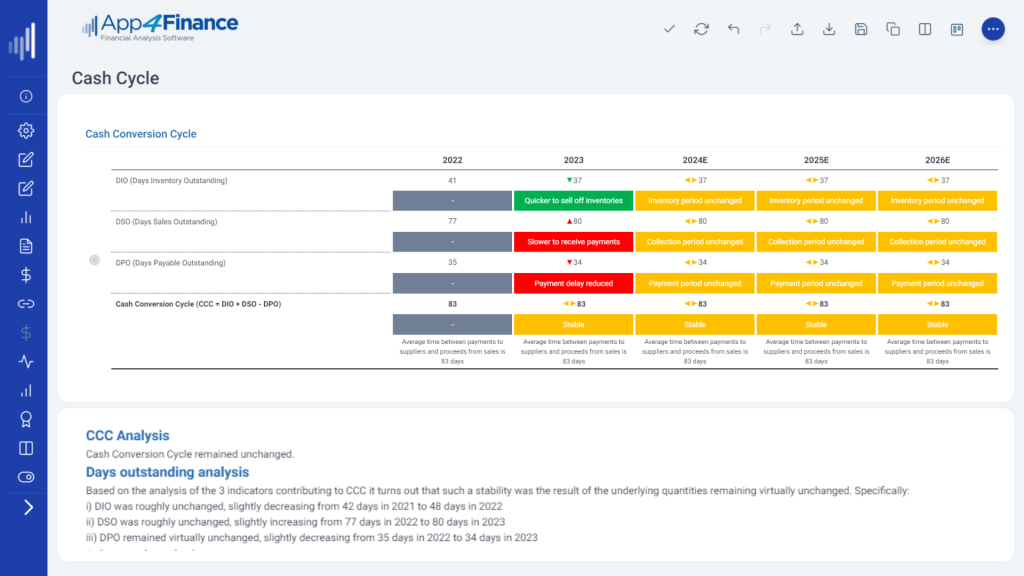

WORKING CAPITAL ANALYSIS

NWC Current assets minus current liabilities

NOWC Net Operating working capital

Cash Conversion Cycle

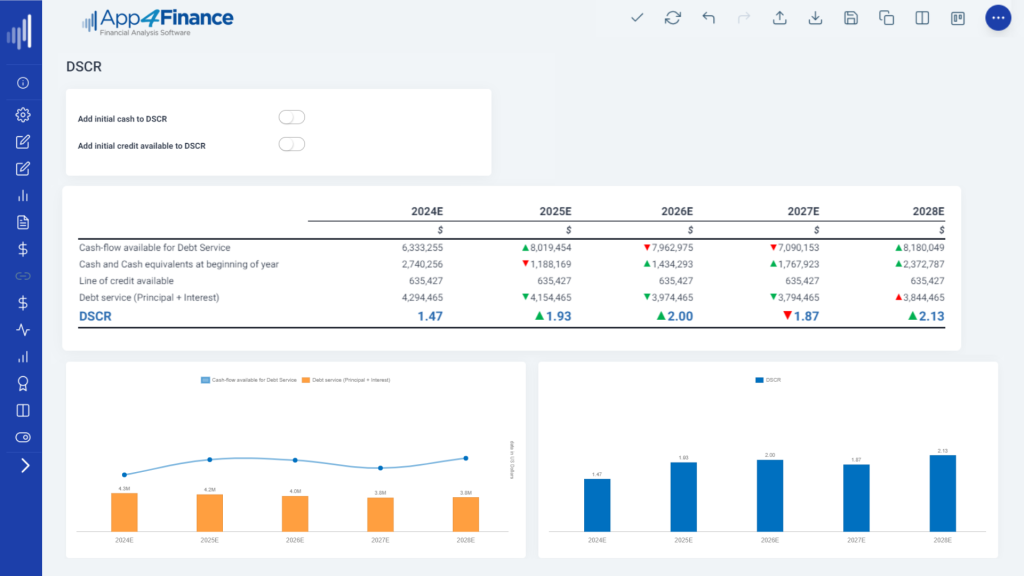

DSCR (DEBT SERVICE COVERAGE RATIO)

Automatic Reporting

Automatic dynamic comments The system, through complex business intelligence algorithms, generates automatic comments discussing the company’s performance and rating.

Downloadable and editable The report can be downloaded on your own device and edited according to your needs.

Download formats The report can be downloaded in: Word file, Excel spreadsheet and Pdf.

How Business Intelligence Works

Complex algorithms automatically generate appropriate comments in accordance with the results of the analysis. Based on the financial data entered, the application determines the trend of the Debt to EBITDA ratio and generates the following comment:

Each area of financial management will be examined and evaluated: if the performance of a specific area (e.g. profitability) is not satisfactory, the system will discuss the reasons of such a negative outcome and will recommend corrective actions to improve it. Our R&D department is continuously working on developing more and more extensive comments and recommendations. Updates are automatically available and 100% free.

Final Results

Automatic Reporting:

Reclassifies Balance Sheet and Income Statement and, then calculates EBIT and EBITDA.

Analyzes performances in different areas of financial management (profitability, liquidity, capital structure, solvency). Evaluates the overall business performance. Assesses creditworthiness and assigns a global rating score. All accounting statements of reclassified financials are based on standards adopted by international financial operators, in order to provide effective communication.

The analysis includes ratios, charts, graphs and comments. These are automatically generated by the system through specific business intelligence algorithms and provide an extensive assessment of the company’s performance. The final report is completely editable and customizable

IFRS

GAAP

1 month

€

Discount of %

- No Contracts/No Automatic Renew

- Professional Support & Continuous Updating

- Unlimited Projects & Automatic Reporting

- Share Projects And Simultaneous Access With Your Staff

- Automatic Financial Analysis Whatif, Multi-Scenario, Multi-Company, Benchmark

- Customizable Reports, Available In Docx, PDF And Excel

3 months

€

Discount of %

- No Contracts/No Automatic Renew

- Professional Support & Continuous Updating

- Unlimited Projects & Automatic Reporting

- Share Projects And Simultaneous Access With Your Staff

- Automatic Financial Analysis Whatif, Multi-Scenario, Multi-Company, Benchmark

- Customizable Reports, Available In Docx, PDF And Excel

12 months

€

Discount of %

- No Contracts/No Automatic Renew

- Professional Support & Continuous Updating

- Unlimited Projects & Automatic Reporting

- Share Projects And Simultaneous Access With Your Staff

- Automatic Financial Analysis Whatif, Multi-Scenario, Multi-Company, Benchmark

- Customizable Reports, Available In Docx, PDF And Excel

monthly payments

12 months

€

Discount of %

- No Contracts/No Automatic Renew

- Professional Support & Continuous Updating

- Unlimited Projects & Automatic Reporting

- Share Projects And Simultaneous Access With Your Staff

- Automatic Financial Analysis Whatif, Multi-Scenario, Multi-Company, Benchmark

- Customizable Reports, Available In Docx, PDF And Excel

1 month

€

Discount of %

- No Contracts/No Automatic Renew

- Professional Support & Continuous Updating

- Unlimited Projects & Automatic Reporting

- Share Projects And Simultaneous Access With Your Staff

- Automatic Financial Analysis Whatif, Multi-Scenario, Multi-Company, Benchmark

- Customizable Reports, Available In Docx, PDF And Excel

3 months

€

Discount of %

- No Contracts/No Automatic Renew

- Professional Support & Continuous Updating

- Unlimited Projects & Automatic Reporting

- Share Projects And Simultaneous Access With Your Staff

- Automatic Financial Analysis Whatif, Multi-Scenario, Multi-Company, Benchmark

- Customizable Reports, Available In Docx, PDF And Excel

12 months

€

Discount of %

- No Contracts/No Automatic Renew

- Professional Support & Continuous Updating

- Unlimited Projects & Automatic Reporting

- Share Projects And Simultaneous Access With Your Staff

- Automatic Financial Analysis Whatif, Multi-Scenario, Multi-Company, Benchmark

- Customizable Reports, Available In Docx, PDF And Excel

monthly payments

12 months

€

Discount of %

- No Contracts/No Automatic Renew

- Professional Support & Continuous Updating

- Unlimited Projects & Automatic Reporting

- Share Projects And Simultaneous Access With Your Staff

- Automatic Financial Analysis Whatif, Multi-Scenario, Multi-Company, Benchmark

- Customizable Reports, Available In Docx, PDF And Excel

Subscription fee includes:

Customer Support

Automatic Reporting

Unlimited Projects