Financial Statement Analysis Software GAAP and IFRS

Evaluate business performance in a click with automatic reporting

- Requires data from two consecutive annual Statements of Financial Position and Income Statements. Users are able to enter up to five years of data.

- Calculate 35 ratios, broken-up in five areas of performance.

- Highlights input errors and indicates appropriate corrections.

- Reclassifies and analyzes the financial data entered by users.

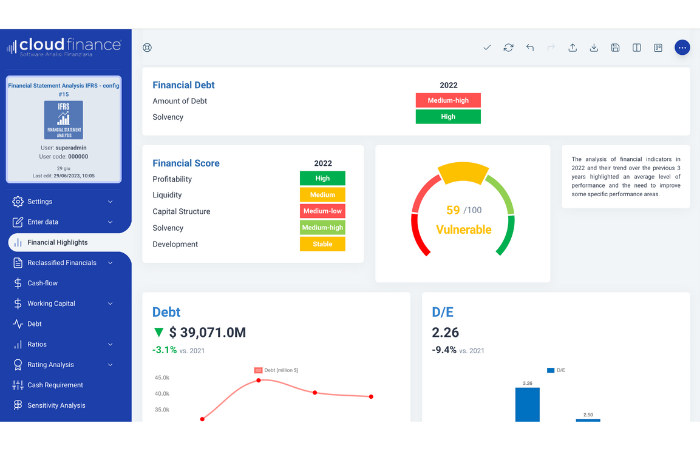

- Evaluates business performance and assigns a comprehensive score indicating the overall financial health. Performance evaluation will be based on the assessment of every single area of financial management (profitability, solvency, capital structure, liquidity) and a specific score will be assigned to each of those areas.

- Automatically generates a financial report, rich in charts, graphs, ratios, and comments obtained through complex business intelligence algorithms.

Automatic Reporting

Automatic reporting

Automatic dynamic comments

Downloadable and editable

Download formats

Designed for professionals

Effective financial communication to stakeholders, through a professional and fine report;

Creditworthiness assessment and company rating;

Financial health assessment;

Investment and financing decisions by managers or external stakeholders.

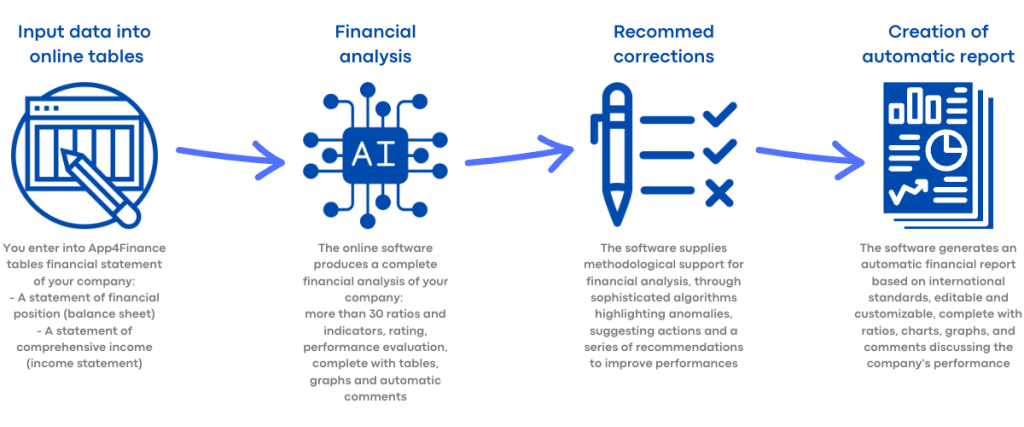

How it works

INPUT DATA

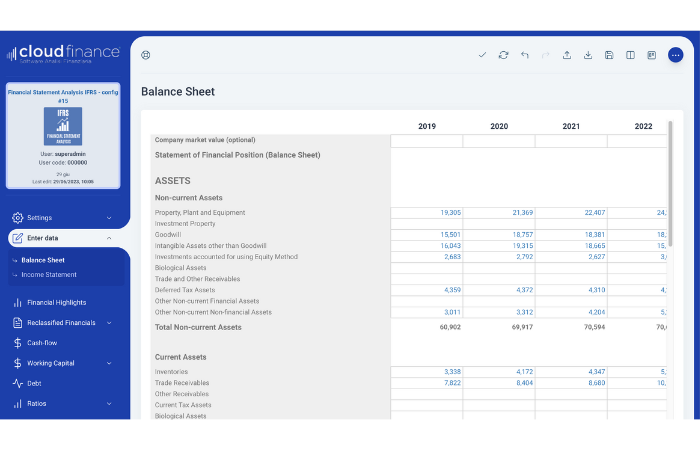

All you need is to enter financial data of the company you intend to assess, classified according to IFRS or US GAAP rules. It is specifically required:

Statement of Financial Position (Balance Sheet);

Statement of Comprehensive Income (Income Statement)

Assets and Liabilities in the Balance Sheet have to be arranged according to a current/non-current classification.

Income Statement is supposed to report “Cost of Goods Sold” separately from any other cost (such as administration or distribution costs).

Some optional data are also required:

Operating cash-flow.

Number of employees.

Amortization and depreciation expense, essential to calculate EBITDA.

All data are required for at least 2 fiscal years (up to a maximum of 5).

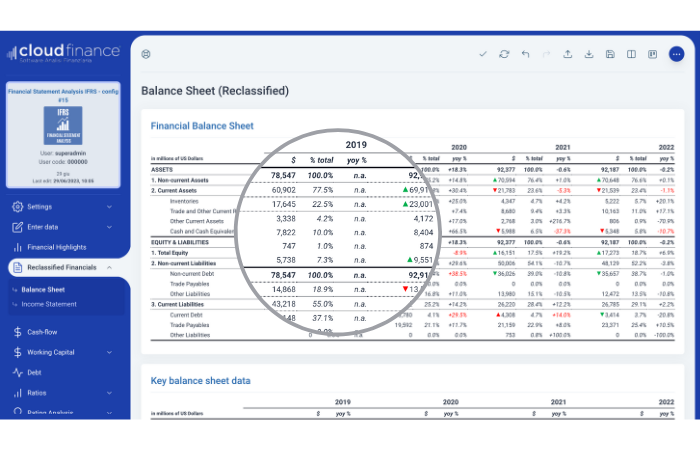

RECLASSIFIED FINANCIALS

Reclassification of Balance Sheet:

Improves the capability to provide information to investors;

lets you immediately figure out the whole picture.

Current Assets are classified into the following categories:

Inventories

Trade and Other Current Receivables (concerning the commercial area)

Other Current Assets (a sum of Current Tax Assets, Biological Assets, Other Current Financial Assets, Other Current Non-financial Assets, Assets Held for Sale) Cash and Cash Equivalents

The application clearly isolates financial debt from trade liabilities, categorizing it into long- and short-term debt. This allows to calculate fundamental ratios as Debt to EBITDA or Debt to Equity ratio.

Reclassification of Income Statement

Reclassified Income Statement separates operating costs from non-operating ones, highlighting EBIT and EBITDA margins. This allows to evaluate essential ratios, such as EBIT to Interest Expense and Debt to EBITDA. Costs are classified into cost of sales and other specific categories, according to their destination.

FINANCIAL HIGHLIGHTS

A summary of the main financial data allows you to get an immediate feeling of the company’s health.

The application highlights how the most relevant economic data (Revenue, EBIT, EBITDA, Net Profit), changed over the years in order to assess profitability trends.

Variations of Equity and Loan Capital are investigated to evaluate the balance of the company’s capital structure.

The application automatically generates extensive comments describing the financial status of the company through the analysis of key performance indicators.

All ratios are presented in a comprehensive table giving a global perspective on the company.

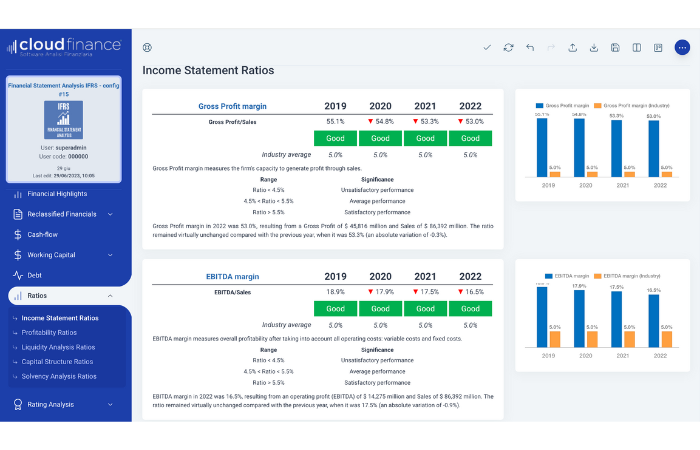

INCOME STATEMENT RATIOS

Gross Profit margin

Measures the firm’s capacity to generate profit through sales.

EBITDA margin

Measures overall profitability after taking into account all operating costs: variable costs and fixed costs.

Profit Before Tax margin

Measures how much revenue is converted into profits, before tax is deducted.

Net Profit margin

It is the percentage of revenue remaining after all expenses (operating, financial and tax) have been deducted from the company’s total revenue.

Operating Cash-flow margin

Measures how much cash is generated from operating activities per unit of revenue.

Revenue per Employee

It is an efficiency metric showing how much revenue is collected per single employee. A higher ratio indicates higher productivity.

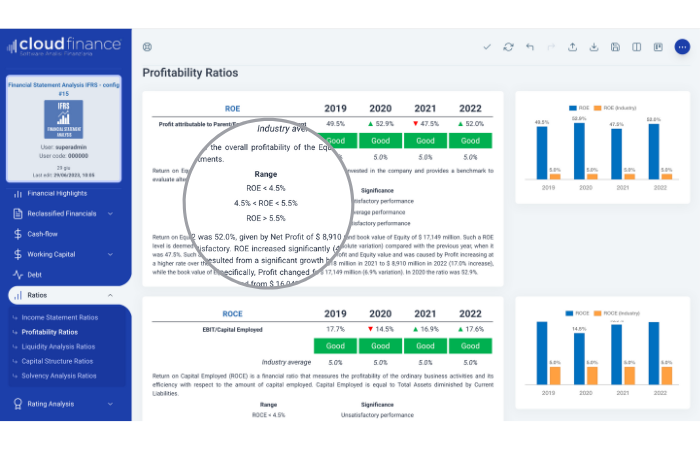

PROFITABILITY RATIOS

ROE – Return on Equity

Measures the overall profitability of the Equity capital invested in the company and provides a benchmark to evaluate alternative investments.

ROCE – Return on Capital Employed

Measures the profitability of the ordinary business activities and its efficiency with respect to the amount of capital employed.

EBIT margin

Reflects the company’s commercial performance and measures the average profit per unit of revenue.

ROA – Return on Assets

Measures the profitability of the company, based on the company’s assets.

Asset turnover

Measures the company’s capacity to generate revenue per unit of asset invested.

Retained Earnings to Total Assets ratio

It is a balance sheet account which records the total amount of profits (or losses) made by a firm over its entire life, net of the dividends paid.

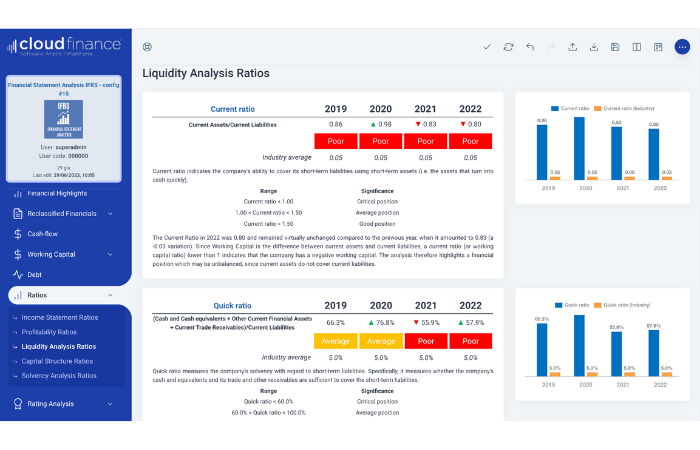

LIQUIDITY ANALYSIS

Liquidity analysis reveals whether the business has sufficient resources available in order to service its debt (interest and principal repayments).

Current ratio

Indicates the company’s ability to cover its short-term liabilities using short-term assets (i.e. the assets that turn into cash quickly).

Quick ratio

Measures the company’s solvency with regard to short-term liabilities.

Cash ratio

It is used to examine the company’s liquidity. It is more conservative than the current ratio and the quick ratio.

Days Payables and Days Receivables

Evaluate the average amount of time it takes the company to pay suppliers and to collect payment from customers.

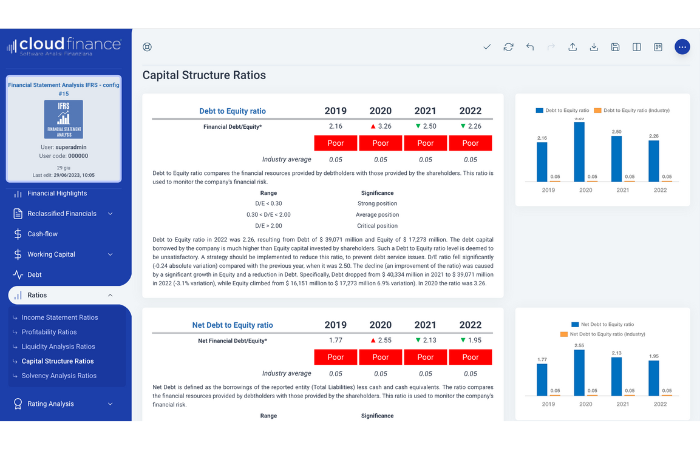

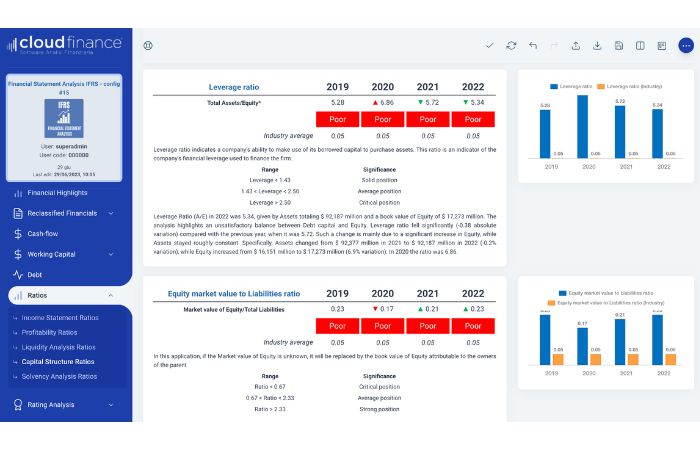

CAPITAL STRUCTURE RATIOS

Capital structure analysis examines the relationship between internal financial resources and debt capital, assessing the viability of the company’s financing strategy.

Debt to Equity ratio

Compares the financial resources provided by debtholders with those provided by the shareholders. This ratio is used to monitor the company’s financial risk.

Net Debt to Equity ratio

It is defined as the borrowings of the reported entity (Total Liabilities) less cash and cash equivalents. The ratio compares the financial resources provided by debtholders with those provided by the shareholders.

Total Liabilities to Assets ratio

Shows how much of company’s assets consist of liabilities.

Total Liabilities to Equity ratio

Compares the whole amount of the company’s obligations to the book value of Equity

Equity to Assets ratio

Assesses the degree of financial independence, i.e. what percentage of total company’s assets is financed by Equity.

Fixed Assets coverage ratio

Fixed Assets Coverage ratio measures the company’s ability to cover required investments in fixed assets by means of equity and debt.

Working Capital to Assets ratio

The working capital to total assets ratio compares the net liquid assets of the firm to the total assets. Working Capital is the difference between current assets and current liabilities, so the Working Capital to Total Assets ratio determines the short-term company’s solvency.

Leverage ratio

Leverage ratio indicates a company’s ability to make use of its borrowed capital to purchase assets.

Equity market value to Liabilities ratio

Compares Equity to the total amount of liabilities, considering the actual market value of the company.

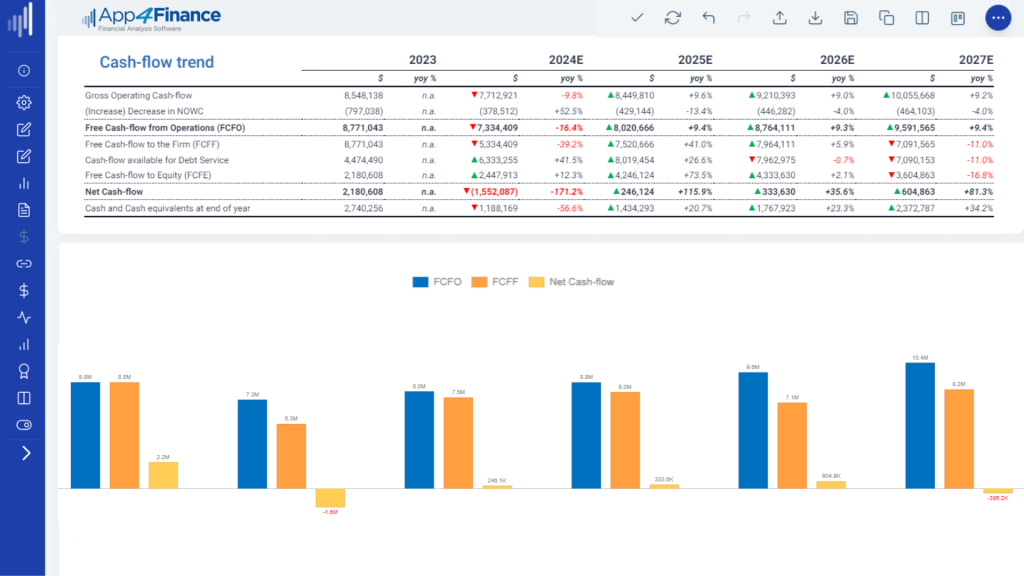

CASH-FLOW STATEMENT

Cash-flow Statement shows the company capability of cash generation (cash inflows) or cash absorption (cash outflows) during the year.

In this way, you can have a highlights of the generation and absorption of financial resources occurred during the year, divided into the main management areas.

The software automatically calculates the Free cash Flow to the Firm and to Equity

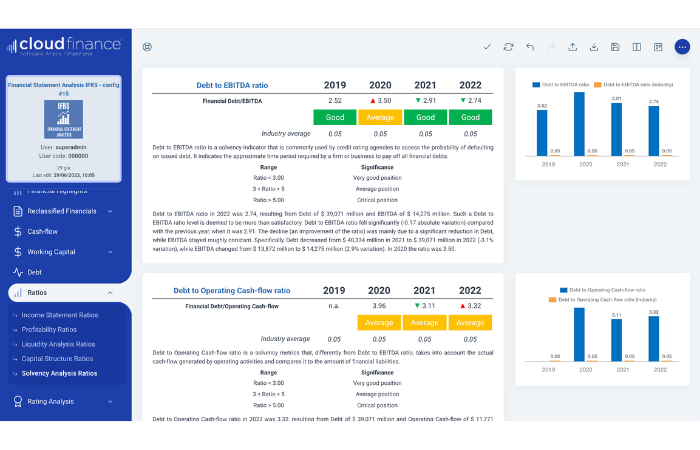

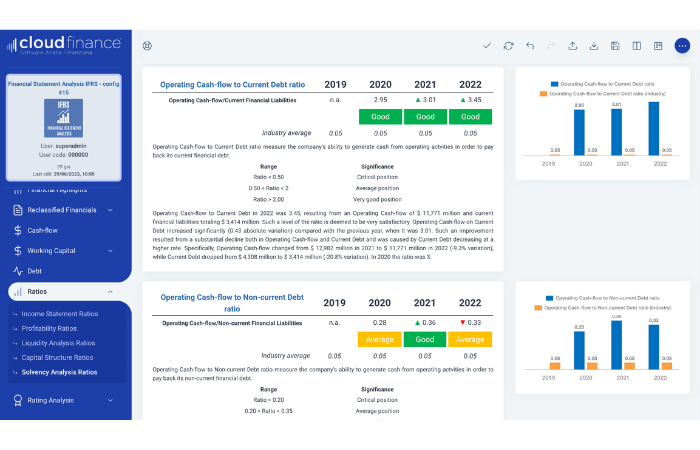

SOLVENCY ANALYSIS

Solvency analysis examines a firm’s capability to meet long term obligations. In general, a solvency ratio compares a measure of profitability to the company’s financial obligations.

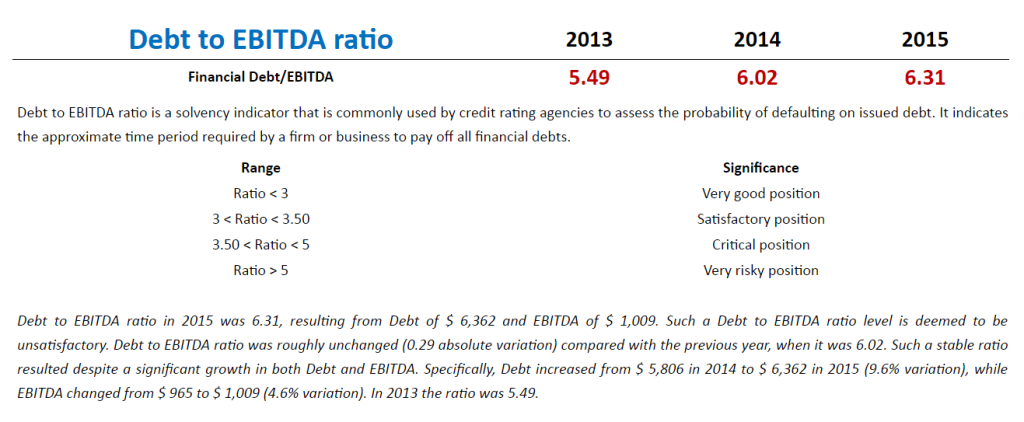

Debt to EBITDA ratio

It is a solvency indicator that is commonly used by credit rating agencies to assess the probability of defaulting on issued debt.

Debt to Operating Cash-flow ratio

Differently from Debt to EBITDA ratio, it takes into account the actual cash-flow generated by operating activities and compares it to the amount of financial liabilities.

Net Debt to EBITDA ratio

It is akin to Debt on EBITDA ratio. Unlike the aforementioned ratio, it takes into account the company’s immediate liquidity, as it involves net financial debt, i.e. Debt minus cash and cash equivalents.

EBIT to Interest coverage ratio

Assesses the company’s ability to cover its finance charges through its operating income.

EBITDA to Interest coverage ratio

Evaluates the company’s ability to cover its finance charges through its operating income, before depreciation and amortization expenses, and share of profit from associates.

Operating Cash-flow to Interest coverage ratio

Assesses the company’s ability to cover its finance charges comparing interest expense to the actual cash amount generated by operating activities.

Operating Cash-flow to Short- and Long-term Debt ratios

Meeasure the company’s ability to generate cash from operating actvities in order to pay back its current and non-current financial debt.

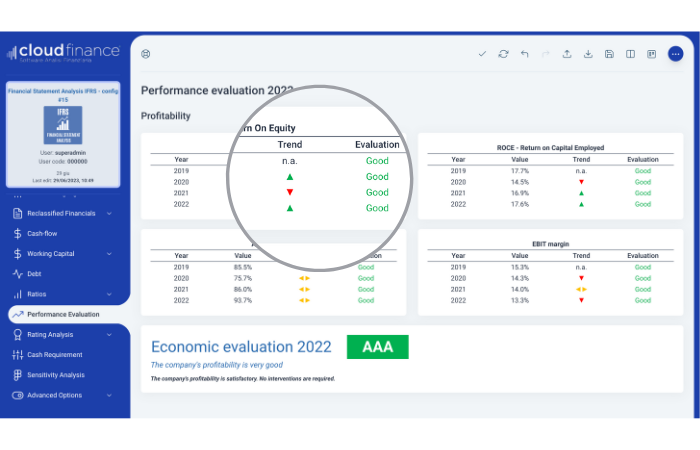

PERFORMANCE EVALUATION

A final evaluation is provided through the assessment of four areas of financial management:

Profitability

Capital Structure

Solvency

Liquidity

A specific score will be assigned to each of those areas. If the performance of a certain area is not satisfactory, the system will discuss the reasons of such a negative outcome and will recommend interventions to improve it.

Finally, the application will assign a global score, processing the results obtained in each separate area trough business intelligent algorithms.

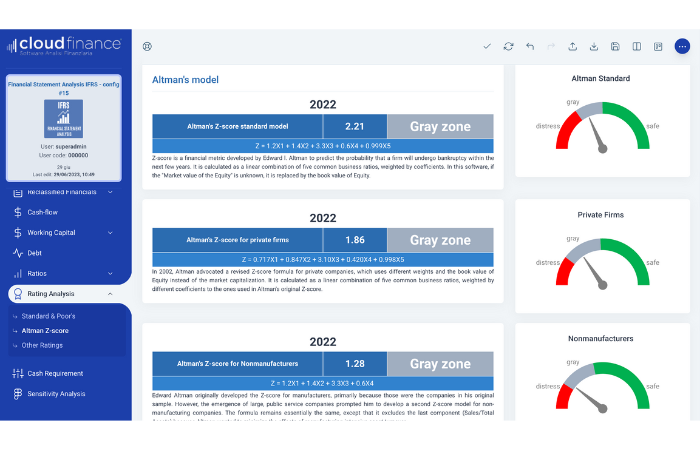

RATING ANALYSIS

Taffler’s model It is an alternative model to assess the likelihood of bankruptcy, based on different parameters and weights, obtained through a specific research on UK companies.

Springate’s model It assigns a score associated to a certain risk of bankruptcy. It is USA specific.

Debt Rating The software, through complex business intelligence algorithms, evaluates the financial debt of the company and assigns a score indicating the debt level and if it is sustainable.

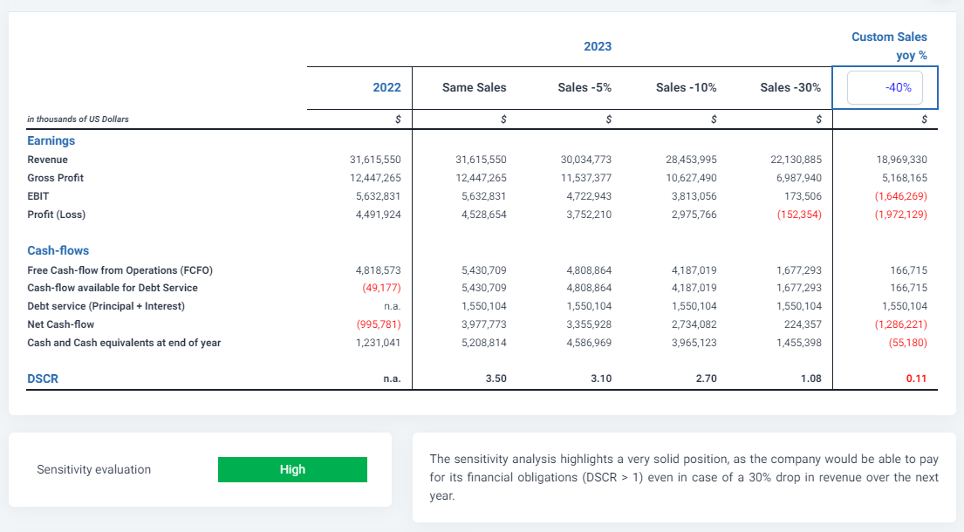

SENSITIVITY ANALYSIS

Sensitivity analysis is a tool for Stress Test and cash-flow simulation designed to estimate the creditworthiness of a business. Based on last year financial data, a forecast of the main economic and cash-flow data is obtained for the next year. The future projections are generated over 4 alternative scenarios: a scenario of stable revenue and 3 more scenarios of incremental sales reduction (a 5%, 10%, and 30% drop), thus conducting a financial stress-test based on sales level. The forecast relies upon a ‘business as usual’ model based on the following assumptions: constant DSO, DIO, DPO, constant cost structure, no investments, no non-recurring or extraordinary income (loss). Debt service principal of the projected year is assumed as equal to the amount of Long-term Debt, current maturities + Current Finance Lease at the end of last year.

You want to look in particular at DSCR to understand what sales reduction rate the company could sustain and still be able to pay for its financial obligations (DSCR > 1). Based on this analysis, the company is assigned a sensitivity score: the more DSCR stays over 1 even in case of significant drops in revenue, the better the evaluation.

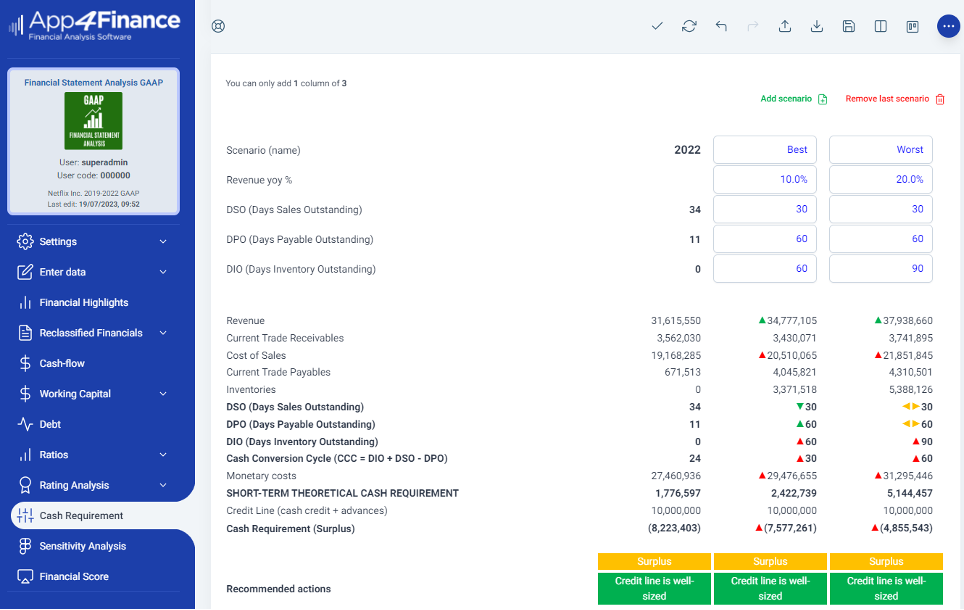

SHORT-TERM CASH REQUIREMENT

With this module, the software accurately computes the required value to ensure that the financial structure of working capital is in balance, and the company does not face tensions or lack of liquidity.

Balance: The NWC requirement is exactly equal to the value of the agreed short-term bank facility.

Underutilization: The NWC requirement is higher than the agreed short-term bank facility. In this case, the software suggests the necessary value to rebalance the situation.

Overutilization: The value of the agreed short-term bank facility is higher than the NWC requirement. The financial structure of the company is not balanced because it is financing long-term uses with short-term sources, leading to higher financial costs.

Through the creation of different scenarios, you can also simulate the impact on financial management that variations in different variables can have (DIO, DSO, DPO, sales and incidence of monetary costs).

AUTOMATIC REPORTING

Automatic dynamic comments The system, through complex business intelligence algorithms, generates automatic comments discussing the company’s performance and rating.

Downloadable and editable The report can be downloaded on your own device and edited according to your needs.

Download formats The report can be downloaded in: Word file, Excel spreadsheet and Pdf.

How Business Intelligence Works

Complex algorithms automatically generate appropriate comments in accordance with the results of the analysis. Based on the financial data entered, the application determines the trend of the Debt to EBITDA ratio and generates the following comment:

Each area of financial management will be examined and evaluated: if the performance of a specific area (e.g. profitability) is not satisfactory, the system will discuss the reasons of such a negative outcome and will recommend corrective actions to improve it. Our R&D department is continuously working on developing more and more extensive comments and recommendations. Updates are automatically available and 100% free.

Final Results

Automatic Reporting:

Reclassifies Balance Sheet and Income Statement and, then calculates EBIT and EBITDA.

Analyzes performances in different areas of financial management (profitability, liquidity, capital structure, solvency). Evaluates the overall business performance. Assesses creditworthiness and assigns a global rating score. All accounting statements of reclassified financials are based on standards adopted by international financial operators, in order to provide effective communication.

The analysis includes ratios, charts, graphs and comments. These are automatically generated by the system through specific business intelligence algorithms and provide an extensive assessment of the company’s performance. The final report is completely editable and customizable

IFRS

GAAP

1 month

€

Discount of %

- No Contracts/No Automatic Renew

- Professional Support & Continuous Updating

- Unlimited Projects & Automatic Reporting

- Share Projects And Simultaneous Access With Your Staff

- Automatic Financial Analysis Whatif, Multi-Scenario, Multi-Company, Benchmark

- Customizable Reports, Available In Docx, PDF And Excel

3 months

€

Discount of %

- No Contracts/No Automatic Renew

- Professional Support & Continuous Updating

- Unlimited Projects & Automatic Reporting

- Share Projects And Simultaneous Access With Your Staff

- Automatic Financial Analysis Whatif, Multi-Scenario, Multi-Company, Benchmark

- Customizable Reports, Available In Docx, PDF And Excel

12 months

€

Discount of %

- No Contracts/No Automatic Renew

- Professional Support & Continuous Updating

- Unlimited Projects & Automatic Reporting

- Share Projects And Simultaneous Access With Your Staff

- Automatic Financial Analysis Whatif, Multi-Scenario, Multi-Company, Benchmark

- Customizable Reports, Available In Docx, PDF And Excel

monthly payments

12 months

€

Discount of %

- No Contracts/No Automatic Renew

- Professional Support & Continuous Updating

- Unlimited Projects & Automatic Reporting

- Share Projects And Simultaneous Access With Your Staff

- Automatic Financial Analysis Whatif, Multi-Scenario, Multi-Company, Benchmark

- Customizable Reports, Available In Docx, PDF And Excel

1 month

€

Discount of %

- No Contracts/No Automatic Renew

- Professional Support & Continuous Updating

- Unlimited Projects & Automatic Reporting

- Share Projects And Simultaneous Access With Your Staff

- Automatic Financial Analysis Whatif, Multi-Scenario, Multi-Company, Benchmark

- Customizable Reports, Available In Docx, PDF And Excel

3 months

€

Discount of %

- No Contracts/No Automatic Renew

- Professional Support & Continuous Updating

- Unlimited Projects & Automatic Reporting

- Share Projects And Simultaneous Access With Your Staff

- Automatic Financial Analysis Whatif, Multi-Scenario, Multi-Company, Benchmark

- Customizable Reports, Available In Docx, PDF And Excel

12 months

€

Discount of %

- No Contracts/No Automatic Renew

- Professional Support & Continuous Updating

- Unlimited Projects & Automatic Reporting

- Share Projects And Simultaneous Access With Your Staff

- Automatic Financial Analysis Whatif, Multi-Scenario, Multi-Company, Benchmark

- Customizable Reports, Available In Docx, PDF And Excel

monthly payments

12 months

€

Discount of %

- No Contracts/No Automatic Renew

- Professional Support & Continuous Updating

- Unlimited Projects & Automatic Reporting

- Share Projects And Simultaneous Access With Your Staff

- Automatic Financial Analysis Whatif, Multi-Scenario, Multi-Company, Benchmark

- Customizable Reports, Available In Docx, PDF And Excel

Subscription fee includes:

Customer Support

Automatic Reporting

Unlimited Projects