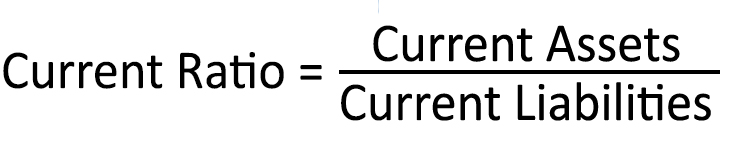

Current Ratio

Current ratio indicates the company’s ability to cover its short-term liabilities using short-term assets (i.e. the assets that turn into cash quickly).

The main difference with the Quick ratio is that Current ratio includes inventories.

The inventory valuation may lead to a different value of the current ratio. A problem might arise because company value inventories using either of two methods, last in, first out (LIFO) or first in, first out (FIFO). Under the LIFO method, inventories are valued at their old costs. If the company has a substantial quantity of inventory, some of it may be carried at relatively low cost. If instead, prices have been falling, the LIFO method will lead to an over¬valued inventory. Under the FIFO method, invento¬ries are valued at close to their current replacement cost. If we have firms that use different accounting methods, and hold substantial invento¬ries, comparisons of current ratios will not be very helpful in measuring their relative strength, unless accounting differences are adjusted for in the com – putations.

Another problem with including inventories in the current ratio derives from the difference between the inventory’s accounting value and its economic value.

For example, a firm which is in a recession or distress will tend to accumulate stocks that fail to sell and the price of the same will not represent the market price at which the firm would sell/would find buyers. This means that in the Current ratio will I find in the denominator in currents assets a value that does not represent and does not necessarily lead to an increase of the same.

Then we may conclude that the quick ratio is always to be preferred? Probably not. If we ignore inventories, firms with readily marketable inventories, will be penalized. Clearly, some judicious further investigation of the marketability of the inventories would be helpful.

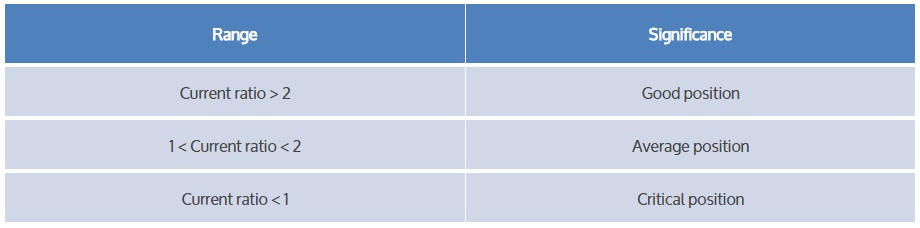

If the value of Current ratio is low, the company may have difficulty meeting current obligations. But low values, however, are not always disastrous. If a company has good long-term prospects, it may be able to find financial resources to satisfy current obligations. The nature of the business itself might also allow it to operate with a current ratio less than one. For example, in an operation like Mc – Donald’s, inventory turns over much more rapidly than the accounts payable become due.

This timing difference can also allow a firm to operate with a low current ratio. Finally, to the extent that the current and quick ratios are helpful indexes of a firm’s financial health, they act strictly as signals of trouble at extreme rates. Some liquidity is useful for an organization, but a very high current ratio might suggest that the firm is sitting around with a lot of cash because it lacks the managerial acumen to put those resources to work. Very low liquidity, on the other hand, is also problematic.

Discover all the features of the software. Request a video call demo with one of our consultants right away.

1 Comment

Comments are closed.

prices of cialis

02/07/2024prices of cialis

prices of cialis