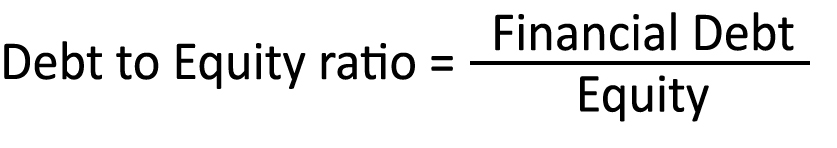

Debt to Equity Ratio

Debt to Equity Ratio compares the financial resources provided by debtholders with those provided by the shareholders. This ratio is used to monitor the company’s financial risk.

The value of the Debt is given by:

A. Current Bank debt

B. Current portion of non current debt

C. Other Current financial debt

D. Current Financial Debt (A)+(B)+(C)

E. Non current Bank loans

F. Bonds Issued

G. Other non current loans

H. Non current Financial Debt (E)+(F)+(G)

I. Financial Debt (D)+(H)

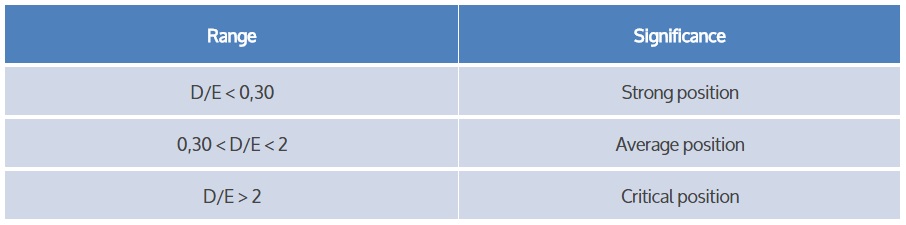

This ratio indicates the degree of balance between funds borrowed from third parties and internal resources. It is often used, mostly by banks, to monitor the financial risk of the company.

However, this relationship is not an absolute measure of a company’s debt because it provides only an assessment of the relationship between external and internal financial resources (also referred to as degree of capitalization of a company).

In addition, the index affects the WACC calculation which, in turn, being the rate at which future cash flows are discounted, determines the value of the company.

If the Debt to Equity ratio is greater than 1, it means that borrowing exceeds the Equity and then the viability of this debt is called into question.

If Debt to Equity ratio is lower than 1, it means that the Equity exceeds the indebtedness, which then is present, but in principle, sustainable.

In some European countries, the net value of Debt is used. This is calculated by subtracting from financial debt the value of very ‘liquid’ financial assets such as government bonds ready for sale, promptly receivable credits, and the amount of cash and cash equivalents.

This is done because in the event of having to repay the debt, these assets can be conveniently used for the purpose. Using this methodology, the absolute value of the debt is lower and the index improves. However, in the financial literature such a methodology has drawn some criticism, mostly because often times a high cash value is actually necessary liquidity to be employed for current management or investments that soon will be made.

Therefore, we have to distinguish on a case-by-case basis: for example, a company like Apple has a huge amount of cash that could be used to repay its debt in a snapshot. Well, in cases like these, perhaps, using a net value of debt would not be a mistake.

Table Net Debt

A. Cash

B. Cash and equivalent

C. Trading securities

D. Liquidity (A)+(B)+(C)

E. Current Financial Receivable

F. Current Bank debt

G. Current portion of non current debt

H. Other Current financial debt

I. Current Financial Debt (F) +(G)+(H)

J. Net Current Financial debt (I)-(E)-(D)

K. Non current Bank loans

L. Bonds Issued

M. Other non current loans

N. Non current Financial Debt (K)+(L)+(M)

O. Net Financial Debt (J)+(N)