DSCR

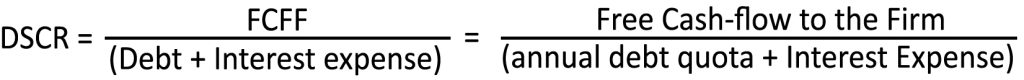

The index, defined as Debt Service Coverage Ratio or debt service bankability indicator, expresses the capacity of the enterprise to generate sufficient cash to service the debt in its two components, represented by principal and interest. It is the ratio, calculated for any given time period of the life of the loans, between the operating cash-flow generated by the project and the debt service including principal and interest. It is used for the analysis of the sustainability of a given level of indebtedness and allows to assess its risk and its cost.

The calculation of the DSCR

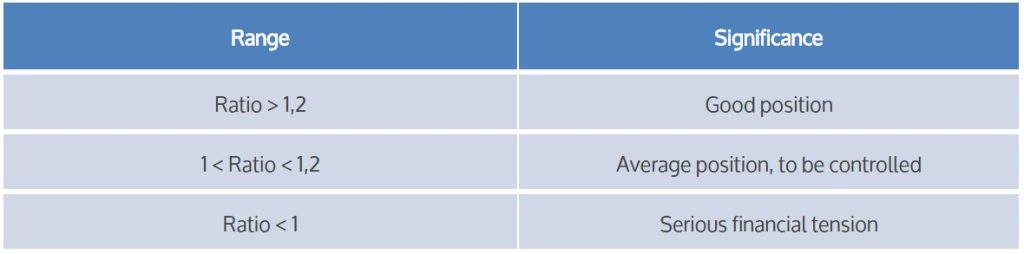

DSCR as the ratio between operating cash flow and the sum of the principal debt and annual interest expense. This index is calculated for each year of the operating life of a project. The purpose of this indicator is to evaluate the ability of a specific investment project to generate sufficient cash to cover debt service operating. Given the function that this indicator performs, international practice has identified reference values for the DSCR ranging from 1.2 to 1.5 depending on the risk level and innovativeness of the project.

A value that is equal to or greater than 1 means that the investment has the capacity to generate sufficient resources to cover the debt payments owed to lenders. In practice, the minimum value is between 1.20 and 1.30 and still depends on the risk profile of the project (the higher the risk, the higher the level required). What is the value of financial debt should I consider? An issue that deserves a feature article is related to the value to be used in the denominator. In fact, while in the numerator we know that cash-flow is represented by the operating level, the same is not so clear regarding the value of the debt. We know that the total value of the debt is the sum of:

A. Current Bank debt

B. Current portion of non current debt

C. Other Current financial debt

D. Current Financial Debt (A)+(B)+(C)

E. Non current Bank loans

F. Bonds Issued

G. Other non current loans

H. Non current Financial Debt (E)+(F)+(G)

I. Financial Debt (D)+(H)

Well, when we talk about Debt formula, is this value the sum of Current Financial Debt and Non-Current Financial Debt as listed in the chart? The answer is that this value is represented solely by the share of debt that the company should return or has returned that year. For this reason, since long-term liabilities are not expected to be returned that year, the only value to consider is represented by the quota that the enterprise should actually return.

Clearly it would be different if, for example, the Bank asked the company to return all or a portion of the exposure. In that case it would be appropriate to add such value in the numerator. And what is the exact value of borrowing costs? In this case it seems appropriate to include the total value of financial charges as recorded on the balance sheet, then both the value related to the long-term debt and the one related to short-term loans. This is because the cost of debt, regardless of which debt has to reward, is still due by the company during the reference year.

So if for example the company had debt given only by the use of an overdraft transfer, in this case in the denominator we would have only the value of borrowing costs, while if the Bank had demanded the return of a portion of the exposure we would rather take the sum of that value with the financial charges.

Discover all the features of the software and calculete your DSCR . Request a video call demo with one of our consultants right away.

1 Comment

Comments are closed.

tadalafil tablets 20 mg reviews

02/05/2024tadalafil tablets 20 mg reviews

tadalafil tablets 20 mg reviews