* (Total Assets-Current Liabilities);

ROCE

Very interesting to understand the evolution of the enterprise is the ROCE, a measure of the profitability of all capital invested (the loan capital as well). As a result, it represents the return obtained by all investors of the company. Investors often calculate ROCE based on ‘Average Capital Employed,’ which takes the average of opening and closing capital employed for the time period.

Before describing the index, let us define what is EBIT.

The ROCE indicates the profitability of operations by comparing EBIT (which is the key margin of any enterprise) with the enterprise dimension (represented by all the invested capital invested, including borrowed funds). Subtracting the value of Current Liabilities from Total Assets you want to exclude any entries which are not sources of financing such as Payables to suppliers, and all liabilities whose purpose is no to finance the business management. This is because a supplier, for example, in granting a deferred payment does not become a lender of the company and does not expect to be paid an interest. Similarly, entries such as provisions accounted for taxes have to be excluded, since they are not part of the invested capital.

ROCE is very useful if you want to compare the performance of companies in sectors such as capital-intensive utilities and telecoms. This is because unlike return on Equity (ROE), which only analyses profitability related to a company’s common Equity, ROCE considers debt and other liabilities as well. In this way, you can have a better indication of financial performance for companies with significant debt. If we wanted to be very thorough, it should be excluded from Current Liabilities those values that instead fund the company as the Current Borrowings and Other Current Financial Liabilities. In addition, if the level of cash is very high and is not actively employed in the business, its value must be subtracted from the capital employed. The table below will clarify the correct computation of the invested capital.

A. Total Assets

B. Current Liabilities (d) + (e) + (f) + (h) + (s) – (c) – (g)

c. Current Borrowings (not included)

d. Current Provisions

e. Trade and Other Current Payables

f. Current Tax Liabilities

g. Other Current Financial Liabilities (not included)

h. Other Current Non-Financial Liabilities

i. Liabilities related to Assets Held for Sale

J. Capital Employed (A) – (B)

If the Cash is not actively employed in the business

k. Cash

L. Capital Employed adjusted (J) – (k)

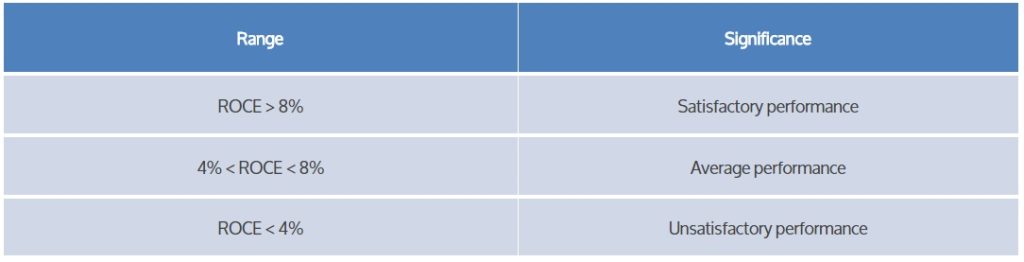

Bear in mind, however, that the index is influenced by accounting and tax policies: EBIT depends on quantities as amortization and provisions, as well as on the assessment of inventories, while the invested capital is affected by the value of fixed assets, inventories and trade receivables. For this reason, you should always do not forget that this value is potentially subject to the company administrators’ choices and fiscal policies. Despite all of this, the index is one of the basic economic indicators, as it highlights the overall efficiency of the company’s core business. To decide whether to undertake a project, the value of the ROCE should be checked with an appropriate minimum level of performance that is represented by the cost of capital.

If ROCE > cost of capital, then accept the project: use of capital is efficient. If ROCE < the cost of capital, reject the project: the company is not employing its capital effectively and is not generating enough value for its shareholders.